|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customs LaW, Import Office

Management, Customs Broker License Preparation Certificates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

These courses provide the formal education for a professional career in the

Customs brokerage & import industry. A logical learning progression

provides a solid foundation to obtain a

Customs License AND progress in a Customs broker or importer's office. |

|

|

Taken selectively by focus area of interest, the courses provide formal

learning for the Customs brokerage employee ori mporter interested in

raising their level of industry knowledge and compliance. |

|

|

Certificates awarded are instrumental for the personal

growth and promotion potential of employees of Customs brokerage or import /

export firms. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customs Law |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The core course for Customs license preparation and/or professional

development for Customs brokers and importers. Covers all the focus topics |

|

|

|

commonly tested by Customs & Border Protection for the Customs License

Exam. This course provides an explanation of the laws and |

|

|

|

regulations covered in CFR 19 and the HTSUS. Instruction time parallels the

historic emphasis areas - classification and valuation, while highlighting |

|

|

|

all pertinent Customs Law matters such as origin determination, duty

preference programs, post entry, fines & penalties, drawback, ADD/CVD, etc. |

|

|

|

One-on-one sessions taught by Licensed Customs

Broker #6631, 11.21.80

|

|

|

|

|

|

|

|

|

|

|

|

|

Offering Dates - on-line - Indiv |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 sessions offfered - Thursdays - 11 x 45 minute sessions -

10:30 AM or 3:00 PM, Starting 10/21/21 |

|

|

|

|

Cost: $825.00 + student responsible for procuring CFR 19 and current HTSUS

- US Government Printing Office or

Free On-Line |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individualized Registration |

|

|

|

|

|

|

Topical Outline |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Structure of CF19 and HTSUS |

|

|

|

|

|

|

|

|

|

|

Tariff Classification of Imported Merchandise |

|

|

|

|

|

|

|

|

|

Valuation of Imported Merchandise |

|

|

|

|

|

|

|

|

|

Country of origin marking requirements |

|

|

|

|

|

|

|

|

|

Country of origin determination |

|

|

|

|

|

|

|

|

|

|

Special tariff provision, trade acts, special product provisions |

|

|

|

|

|

|

|

|

Duty preference programs - trade acts, FTZ, Bonded Whse, Chp 10 |

|

|

|

|

|

|

|

|

Customs Bonds & liquidated damages |

|

|

|

|

|

|

|

|

|

Post entry - protest, prior disclosure, reconciliation |

|

|

|

|

|

|

|

|

|

Drawback |

|

|

|

|

|

|

|

|

|

|

|

|

Intellectual Property Rights |

|

|

|

|

|

|

|

|

|

|

Antidumping / Countervailing Duties |

|

|

|

|

|

|

|

|

|

Customs enforcement actions - penalties, detentions, seizures |

|

|

|

|

|

|

|

|

Nuts & Bolts - release process, quota, misc entry types, general order, user

fees, carnets, duty relief |

|

|

Subscription Furnished with each course of this training...The

International Operations Manual on HCB

Cloud

Policies and procedures to run a

Customs brokerage office "How to" not found in the

regulations Customs compliance review - suitable

for your client's use Clearance tutoring guidelines -

practical tutoring to work in a Customs brokerage operation Import trade references - deep and

specialized Internet links, periodicals & books available to refine your

professionalism Operation formats useful in a

Customs brokerage operation

|

|

|

|

|

................................................................................................................................................................................................................................................................................................... |

|

|

Import Office Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Import Office Management Overview video

Import

Office Management Background Information

|

|

|

|

|

Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This course is ideal for the employee of an import / export business. The

learning objectives are in part taught through shipment scenarios |

|

|

|

and management "wizards." The student will understand importer compliance

responsibilities through the course "wizard" tools and resources. |

|

|

|

Course objectives also include getting the most from your Customs broker and

how to manage an import operation vis-à-vis clearance activities. |

|

|

|

One-on-one sessions taught by Licensed Customs

Broker #6631, 11.21.80

|

|

|

|

|

|

|

|

|

|

|

|

|

Offering Dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 x 45 minute on-line sessions. Weekly

Sessions offered at 3:00 PM or 7:00 PM Thursdays starting 1/20/22 |

|

|

|

|

|

|

|

Cost: $300.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individualized Registration |

|

|

|

|

|

|

|

|

|

Topical Outline |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Transaction Concept |

|

Compliance |

|

|

|

|

|

|

|

|

Preshipment Planning |

|

Reasonable Care |

|

|

|

|

|

|

|

Purchase Order Wizard |

|

Recordkeeping |

|

|

|

|

|

|

|

Supplier Relationship Management |

Binding Rulings Program |

|

|

|

|

|

|

|

|

|

Compliance Measurement |

|

|

|

|

|

|

Customs Law Highlights |

|

|

Prior Disclosure |

|

|

|

|

|

|

|

Appraisment by CBP |

|

CAT Teams |

|

|

|

|

|

|

|

HTS Classification |

|

Audits & Reviews |

|

|

|

|

|

|

|

|

Drawback |

|

C-TPAT |

|

|

|

|

|

|

|

|

IPR |

|

|

|

|

|

|

|

|

|

|

Duty Deferral |

Import Traffic Management |

|

|

|

|

|

|

|

|

|

Fines Penalties Forfeitures |

|

INCOTERMS |

|

|

|

|

|

|

|

|

Liquidated Damages |

|

International Shipping |

|

|

|

|

|

|

|

|

Trade Agreements |

|

Marine Insurance |

|

|

|

|

|

|

|

|

|

|

Container Specifications |

|

|

|

|

|

|

Customs Clearance |

|

|

Quote Guidance |

|

|

|

|

|

|

|

|

Preparation 7501 |

|

Warehouse Functions & Guidelines |

|

|

|

|

|

|

|

|

ACE Entry Summary |

|

|

|

|

|

|

|

|

|

|

Broker functions |

Import Wizard |

|

|

|

|

|

|

|

|

|

Entry Process |

|

HCB's Importer of Record Management Tool |

|

|

|

|

|

|

|

|

Import Documentation |

|

Import Wizard Demos |

|

|

|

|

|

|

|

|

|

Importer Security Filing |

|

|

|

|

|

|

|

|

|

|

|

|

Late Payment of Duty |

|

Import Operations Manual |

|

|

|

|

|

|

|

|

|

|

Refunds and Protests |

|

|

Import Manual Components |

|

|

|

|

|

|

|

|

|

|

|

|

Import Manual Demos |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription Furnished with each course of this training...The

International Operations Manual on HCB

Cloud

Policies and procedures to run a

Customs brokerage office "How to" not found in the

regulations Customs compliance review - suitable

for your client's use Clearance tutoring guidelines -

practical tutoring to work in a Customs brokerage operation Import trade references - deep and

specialized Internet links, periodicals & books available to refine your

professionalism Operation formats useful in a

Customs brokerage operation

|

|

|

|

|

................................................................................................................................................................................................................................................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customs Broker License Preparation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recommended certificate - Customs Law |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One-on-one sessions taught by Licensed Customs Broker #6631, 11.21.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

With the learning foundation of the Customs Law course, the student is given a "refresher"

just prior to the offering of the Customs License examination. This reviews

the focused areas likely to be |

|

|

|

tested and provides practical preparation for taking the examination.

Extensive drills of previously-tested material is

provided by Customs Law topical area. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offering Dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 x 45 minute weekly on-line sessions - 11:30 AM or 7:00 PM

Course A - Just prior to the April Customs License Examination,

Thursdays each week starting 3/3/22

Course B - Just prior to the October Customs License Examination.

Thursdays each week starting 9/9/21 |

|

|

|

|

|

|

|

|

|

Cost: $450.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Individualized Registration - This is

a one-on-one tutoring format, not a group course. This affords maximum

individual attention! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Topical Outline |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Review of the highlights of Customs Law topics likely to be questioned in

the Exam

|

|

|

|

|

|

|

|

|

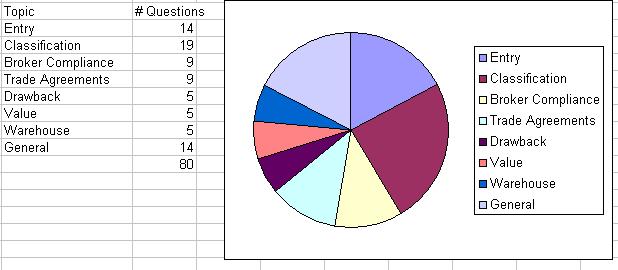

Examples of 80 question breakdown of 2 previous exams |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Anatomy of a test question

|

|

|

|

|

|

|

|

|

|

|

- Practical exercises - where to find answer in

HTS or Regulations?

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Actual past question homework by underlying theme

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription Furnished with each course of this training...The

International Operations Manual on HCB

Cloud

Policies and procedures to run a

Customs brokerage office "How to" not found in the

regulations Customs compliance review - suitable

for your client's use Clearance tutoring guidelines -

practical tutoring to work in a Customs brokerage operation Import trade references - deep and

specialized Internet links, periodicals & books available to refine your

professionalism Operation formats useful in a

Customs brokerage operation

|

|